My Real Estate Blog - My views, analysis and opinions are my own and are protected by the First Amendment (freedom of speech) and do not necessarily reflect the views or opinions of any real estate brokerage company or real estate trade organization. They are also not intended as giving or providing "legal advice".

Pages

- Home - Blog

- Mission Statement

- Biographical

- Military Relocation

- Short Sale & Foreclosure Resource

- Buyer Agency

- Mentoring

- Residential - FOR SALE

- Commercial - FOR SALE

- Copyright Notice

- Paralegal Services

- Notary Public

- Income Tax Return Preparation

- Car Buying Service

- Client Testimonials & Endorsements

- Contact

Welcome

Hi, and welcome to my real estate blog site. I hope you find the information here useful, informative, thought provoking, and perhaps good for even a chuckle or two. Please feel free to join in and participate by leaving a comment, suggestion or question. On the right side column navigation panes you will find areas for getting around on this site and some helpful links as well. To search my blog site for a topic of interest to you either use the search box in the upper left hand corner menu bar or use the blog archive on the right side column pane. Thanks for stopping by... And if you, or someone you know, is looking to buy or sell a property in Northern Virginia, please contact me or call at (703) 615-1036.

Monday, January 26, 2015

How & Why Water Pipes Can Freeze in Your Home

Here's a great video from the Weather channel that illustrates how and why copper water pipes in your house can freeze up and burst.

Wednesday, October 15, 2014

Thursday, March 27, 2014

Home Office Tax Dedeuction

-

2 Deduction Options When You Work From Home

Like things easy? The new simplified home office deduction may be your salvation from the long form. But you might not save as much the easy way. Read

Visit houselogic.com for more articles like this.

Copyright 2014 NATIONAL ASSOCIATION OF REALTORS®

Home Ownership and Your 2013 Taxes

-

What You Should Know About Your Home and Your 2013 Taxes

It’s the last year for three sweet home tax benefits, but the first for a way simpler home office deduction. Read

Visit houselogic.com for more articles like this.

Copyright 2014 NATIONAL ASSOCIATION OF REALTORS®

Home Owner Tax Deduction Questions

-

Your Top Home Ownership Tax Questions Answered

Which tax benefits do home owners miss? Will you get audited if you take the home office deduction? Find out the answers to these questions and more before Tax Day. Read

Visit houselogic.com for more articles like this.

Copyright 2014 NATIONAL ASSOCIATION OF REALTORS®

A Trust is NOT an Entity - It's a Relationship (Symantics)

The Problem:

Practitioners, and occasionally even some courts, will refer to assets as being “owned” by a trust, or will say that someone is “suing” the trust. This likely arises from the fact that proper designation often involves cumbersome syntax. For instance, saying a home is “owned by a trust” is shorter and far more natural than saying a home is “legally owned by Jane Trustee to hold in trust for the benefit of John Beneficiary.” And, in casual conversation, both phrases would communicate the same idea. But the difference between the two can have serious repercussions, as the California Court of Appeal recently struck back against this loose language in Portico Management Group, LLC v Alan Harrison et al Case No. C062060, December 28, 2011

The Case:

In Portico, a property management company entered into a contract to buy an apartment complex that was owned by a married couple as trustees of two trusts. When the deal fell through, the company sued the trustees. The lawsuit properly named the couple as trustees and the case was sent to arbitration pursuant to the purchase contract. The company won an award of $1.6 million, but while the company properly sued the couple as trustees, the arbitrator’s award read “the General Trustees are not personally liable for their acts as trustees of an irrevocable Trust… Thus, the award in this case is against [the trusts] in proportion to their ownership interest in [the property].” When petitioning for the trial court to confirm the arbitrator’s award, the company proposed that judgment be entered against the couple as trustees of the trust. The couple objected and the trial court agreed with them. Judgment was entered against the trusts, not against the couple as trustees of the trust.

Instead of applying to the arbitrator to change the award or petitioning the trial court to correct the award, the company tried to enforce the judgment against the trustees. After years of litigation, the Court of Appeal eventually found that the company could not enforce the judgment because the judgment was against the trust itself, and to add judgment debtors at this stage would violate the trustees’ due process rights. A judgment debtor must be a person, and a trust is not a person, it is a relationship.

The Takeaway:

Despite the fact published opinions will often employ casual shorthand to the effect that trusts “own” property or a trust is “being sued,” this is not technically correct. And as the company learned, painfully, technicalities matter. A trust is not an entity; it is a relationship with respect to certain property. Trusts cannot satisfy judgment debts because trusts are not persons. If judgment is mistakenly entered against a trust, the remedy is to appeal the judgment that is actually entered, not to try to enforce a judgment as it should have been written.

Friday, March 21, 2014

National Association of REALTORS (NAR) Files Lawsuit Filed Against Zillow

I am not a big fan of Zillow at all. This site misguides the public and their data if often fraught with glaring errors and discrepancies. Rather than the public turning to a true licensed professional REALTOR (or a local Association or Board of Realtors) for advise and counsel on real property matters and local market conditions, and statistics; the reliance upon information contained in Zillow.com is a HUGE mistake for any consumer of real estate property related services.

http://news.move.com/2014-03-17-Move-and-NAR-File-Suit-Against-Zillow-and-Samuelson

SAN JOSE, Calif., March 17, 2014 /PRNewswire/ -- Move, Inc. (NASDAQ: MOVE), an online leader in real estate, today filed a lawsuit against Zillow, Inc. (NASDAQ:Z) and Errol Samuelson in the Superior Court of King County, Washington for breach of contract, breach of fiduciary duty, and misappropriation of trade secrets among others actions. The National Association of REALTORS and its subsidiary Realtors Information Network, Inc. joined as plaintiffs in the suit.

"At Move, we take our trade secrets and intellectual property extremely seriously as a valuable asset in our competitive position in the marketplace," said Steve Berkowitz, CEO of Move. "We take action in cases in which we believe our trade secrets have been compromised. We have raised this matter for the courts and believe that the matter will be resolved judiciously."

About Move, Inc.

Move, Inc. (NASDAQ:MOVE), a leader in online real estate, operates: realtor.com®, the official website of the National Association of REALTORS®; Move.com, a leading destination for new homes and rental listings, moving, home and garden, and home finance; ListHub™, the leading syndicator of real estate listings; Moving.com™; SeniorHousingNet; SocialBios; Doorsteps®; TigerLead® Top Producer® Systems and FiveStreet. Move is based in San Jose, California.

http://news.move.com/2014-03-17-Move-and-NAR-File-Suit-Against-Zillow-and-Samuelson

Move and NAR File Suit Against Zillow and Samuelson

Complaint details misappropriation of trade secrets and confidential information

Mar 17, 2014

SAN JOSE, Calif., March 17, 2014 /PRNewswire/ -- Move, Inc. (NASDAQ: MOVE), an online leader in real estate, today filed a lawsuit against Zillow, Inc. (NASDAQ:Z) and Errol Samuelson in the Superior Court of King County, Washington for breach of contract, breach of fiduciary duty, and misappropriation of trade secrets among others actions. The National Association of REALTORS and its subsidiary Realtors Information Network, Inc. joined as plaintiffs in the suit.

"At Move, we take our trade secrets and intellectual property extremely seriously as a valuable asset in our competitive position in the marketplace," said Steve Berkowitz, CEO of Move. "We take action in cases in which we believe our trade secrets have been compromised. We have raised this matter for the courts and believe that the matter will be resolved judiciously."

About Move, Inc.

Move, Inc. (NASDAQ:MOVE), a leader in online real estate, operates: realtor.com®, the official website of the National Association of REALTORS®; Move.com, a leading destination for new homes and rental listings, moving, home and garden, and home finance; ListHub™, the leading syndicator of real estate listings; Moving.com™; SeniorHousingNet; SocialBios; Doorsteps®; TigerLead® Top Producer® Systems and FiveStreet. Move is based in San Jose, California.

Saturday, November 23, 2013

What Company Do You Work For?

Invariably, the very FIRST question I am always asked when I mention to someone that I am a Realtor is, "What company do you work for?"

My answer goes something like this:

I fully understand why "brand" or "branding" matters, however. A company's brand or logo is very important when it comes to tangible products like automobiles, watches, clothing, restaurants, etc because the consumer learns to associate those brands, logos or trademarks with a quality product. Conversely, the consumer or the public will also stay away from a certain brand or logo based on either actual, objective and empirical knowledge, or first hand experience with a product or company; or based on their own subjective perception of brand quality.

But how does "brand" or "branding" work with something intangible like a professional service?

A Realtor is providing a professional SERVICE to you. THAT is the "product" that you are actually consuming.

The product is ME and MY services, and NOT those of the real estate broker franchise. People use me as a Realtor for and because of ME and MY services, and not for the services of the real estate broker franchise.

What makes illogical sense is for a consumer to base their decision solely on what company name or logo is on a Realtor's business card. Furthermore, the real estate broker franchise name and logo on my card is NOT MY OWN but is someone Else's "brand" or logo. So, why should choosing ME be based on someone Else's brand or logo?!

As Mr. Spok from Star Trek would say, "that's highly illogical"

My answer goes something like this:

- I don't work for "them", I split my commissions with and I pay my broker; my broker does not split his commissions with me and he does not pay me - I PAY HIM! I am not an "employee" of the company, but am an independent contractor and sole proprietor. Unlike any other licensed profession (doctor, lawyer, CPA, Translator/Interpreter, etc) the real estate industry was set up whereby a real estate licensee or agent must be tethered to or affiliated with a broker and cannot operate independently, even though the licensee or agent is already licensed and meets all the safeguards and protections to the public that are required by a Department of Professional & Occupational Regulation.

- The real estate broker company that I am affiliated with is not the one who is either going to be driving you around looking at houses if you're a buyer and writing the sales contract for you. The "company" is not the one who will be listing your home for sale if you are the seller. The "company" is not going to come and take the pictures of your home, put up a for sale sign and a lockbox, tell you what the market value of your home is by conducting a Comprehensive Market Analysis (CMA) or "comps", and handling every aspect of your transaction all the way through closing. The "logo" or the "brand" is not going to do all that.... I AM.

- What "flag" I fly under is completely irrelevant really. There is some minor value in the company name or logo; but the real value is MY expertise, knowledge and experience in the local market.

- Now, lets talk about MY experience and MY professional background and why MY unique talents and skills make ME, the Realtor of Choice... (regardless what name or logo is on my business card)

I fully understand why "brand" or "branding" matters, however. A company's brand or logo is very important when it comes to tangible products like automobiles, watches, clothing, restaurants, etc because the consumer learns to associate those brands, logos or trademarks with a quality product. Conversely, the consumer or the public will also stay away from a certain brand or logo based on either actual, objective and empirical knowledge, or first hand experience with a product or company; or based on their own subjective perception of brand quality.

But how does "brand" or "branding" work with something intangible like a professional service?

A Realtor is providing a professional SERVICE to you. THAT is the "product" that you are actually consuming.

The product is ME and MY services, and NOT those of the real estate broker franchise. People use me as a Realtor for and because of ME and MY services, and not for the services of the real estate broker franchise.

What makes illogical sense is for a consumer to base their decision solely on what company name or logo is on a Realtor's business card. Furthermore, the real estate broker franchise name and logo on my card is NOT MY OWN but is someone Else's "brand" or logo. So, why should choosing ME be based on someone Else's brand or logo?!

As Mr. Spok from Star Trek would say, "that's highly illogical"

Friday, November 8, 2013

Middle Class Homebuyers Getting Priced Out of the Market

Here is a good article below which describes the plight of affordable housing for even the middle class, let alone those who are marginalized. This article reminds me of a news story in Fairfax County, Virginia a few years back when then Fairfax County District Superior Sharon Bullova headed up a task force on "boarding houses" particularly in the Springfield area and was obviously also "profiling" or targeting Hispanics. While this is a valid zoning issue - why didn't Supervisor Bullova tackle the underlying problem of affordable housing instead ??!! Treat the cause... not the symptoms Mrs. Bullova!! (She does not have a college education or degree by the way)

The National Low Income Housing Coalition (NLIHC) publishes some great reports which breaks down what the "hourly housing wage" is in their "Out of Reach" reports.

Middle-class home buyers are struggling to find enough affordable homes on the market as rising prices, higher interest rates, and flat incomes limit their choices.

More than half of homes for sale this month in 14 of the 100 largest metros were out of reach for middle-class home buyers, according to a new study by Trulia. The real estate company based affordability rates on a monthly payment — after a 20 percent down payment as well as taxes and insurance costs — that was less than 31 percent of the metro area’s median household income.

The number of affordable homes for middle-class buyers has decreased or stayed flat in 99 metros since October 2012, Trulia found. Rochester, N.Y., was the only metro to see a gain.

Places like Orange County, Calif., have seen the worst tightening of affordable inventory for middle-class buyers. In 2012, 44 percent of homes there were affordable to the middle class; that has fallen to 23 percent this year.

A big drop in foreclosures and lower-priced homes is a major catalyst of the shift. The percentage of existing home sales nationwide that were distressed properties selling at discounts has fallen from 23 percent last year to 12 percent as of August, according to the National Association of REALTORS®.

Though housing affordability for the middle class appears to be the most problematic in California, other metros are also seeing affordability lessen by big margins. In Boston, middle-class buyers now can afford 41 percent of homes on the market, down from 53 percent last year. In Denver, the percentage has fallen from 70 percent to 55 percent. Seattle has gone from 66 percent to 55 percent

The following are the markets with the least number of affordable homes for the middle class, according to Trulia’s study:

The National Low Income Housing Coalition (NLIHC) publishes some great reports which breaks down what the "hourly housing wage" is in their "Out of Reach" reports.

In Virginia, the Fair Market Rent (FMR) for a two-bedroom apartment is $1,078. In order to afford this level of rent and utilities – without paying more than 30% of income on housing – a household must earn $3,592 monthly or $43,108 annually. Assuming a 40-hour work week, 52 weeks per year, this level of income translates into a Housing Wage of $20.72.

In Virginia, a minimum wage worker earns an hourly wage of $7.25. In order to afford the FMR for a two-bedroom apartment, a minimum wage earner must work 114 hours per week, 52 weeks per year. Or a household must include 2.9 minimum wage earners working 40 hours per week year-round in order to make the two-bedroom FMR affordable.

In Virginia, the estimated mean (average) wage for a renter is $15.79. In order to afford the FMR for a two-bedroom apartment at this wage, a renter must work 52 hours per week, 52 weeks per year. Or, working 40 hours per week year-round, a household must include 1.3 workers earning the mean renter wage in order to make the two bedroom FMR affordable.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Middle-Class Buyers Getting Edged Out?

Daily Real Estate News |

Sunday, October 13, 2013

Middle-class home buyers are struggling to find enough affordable homes on the market as rising prices, higher interest rates, and flat incomes limit their choices.

More than half of homes for sale this month in 14 of the 100 largest metros were out of reach for middle-class home buyers, according to a new study by Trulia. The real estate company based affordability rates on a monthly payment — after a 20 percent down payment as well as taxes and insurance costs — that was less than 31 percent of the metro area’s median household income.

The number of affordable homes for middle-class buyers has decreased or stayed flat in 99 metros since October 2012, Trulia found. Rochester, N.Y., was the only metro to see a gain.

Places like Orange County, Calif., have seen the worst tightening of affordable inventory for middle-class buyers. In 2012, 44 percent of homes there were affordable to the middle class; that has fallen to 23 percent this year.

A big drop in foreclosures and lower-priced homes is a major catalyst of the shift. The percentage of existing home sales nationwide that were distressed properties selling at discounts has fallen from 23 percent last year to 12 percent as of August, according to the National Association of REALTORS®.

Though housing affordability for the middle class appears to be the most problematic in California, other metros are also seeing affordability lessen by big margins. In Boston, middle-class buyers now can afford 41 percent of homes on the market, down from 53 percent last year. In Denver, the percentage has fallen from 70 percent to 55 percent. Seattle has gone from 66 percent to 55 percent

The following are the markets with the least number of affordable homes for the middle class, according to Trulia’s study:

-

San Francisco

Percentage of homes affordable to middle class: 14.2%

Maximum affordable home price: $409,000 -

Orange County, Calif.

Percentage of homes affordable to middle class: 23.1%

Maximum affordable home price: $373,000 -

Los Angeles

Percentage of homes affordable to middle class: 24%

Maximum affordable home price: $271,000 -

New York

Percentage of homes affordable to middle class: 25.3%

Maximum affordable home price: $274,000 -

San Diego

Percentage of homes affordable to middle class: 28.4%

Maximum affordable home price: $309,000

Friday, October 25, 2013

Did Someone Die in This House?

Here's an interesting article below worth considering. Perhaps this should be added to "SOP" (Standard Operating Procedure) "due diligence" on the part of a buyer agent, or settlement company? Perhaps there should be an "Contract Addendum Disclosusre" added to the regional sales contract. The prospective buyer could be given a 3 day right of rescission under the contract contingencies addendum for "ghosts" or other paranormal activity in the home! LOL

A text in the night put Roy Condrey on the trail of the dead.

"Did you know that your house is haunted?" read the letters glowing on his screen. It wasn't a message from beyond, but rather came from one of the tenants in the properties he rents out to supplement his income as a software project manager.

But the text got him pondering: Even if you suspected you had a paranormal force inhabiting your home, how could you tell if someone died in it?

Thus was Diedinhouse.com born. The site cross references between public records and other databases to find who used to live in a particular U.S. address, whether they're alive or not, and if they died while in the house. It can tell prospective homebuyers information the seller isn't obligated to disclose, which can sometimes lower a house's final price.

The night the idea was germinating, Condrey sat in front of the computer and began searching for answers. He discovered it's not that easy to electronically dig up a body under your roof.

From one source he could get a list of everyone who lived in the house. Then he had to check each name against another list to see if they were alive. Other databases and searches could turn up clues as to whether their death happened at the address itself. Few states require sellers to disclose if anyone died in the home, even if it was a murder-suicide that everyone else in the neighborhood knows about.

By and large, it's let the buyer beware ... of ghosts.

In that informational void Condrey saw opportunity. He grabbed a few programmer pals, and in June of this year his wesbite was spawned. In the first five months, it sold a few thousand reports for $11.99 per U.S. address searched. A few Halloween-minded media mentions later and it's now selling a thousand per day.

"I can't confirm or deny ghosts," said Condrey. "I want to know if I'm moving into Andrea Yates' house where she drowned five children in the bathtub."

It's like a Carfax for haunted houses.

Besides the curious and those in the spooky spirit, the site is also getting traction among ghost hunters.

Leslie Self, 36, a caregiver and pro bono paranormal investigator in Craig, Colo., has used a Diedinhouse report for six of his recent clients.

In one case, a couple was bedeviled by knocking sounds in the night in the home the woman inherited from her grandmother. Self ran a search on Diedinhouse and didn't find any evidence the grandmother had died in the house. After descending into the basement, he discovered the ghastly noises in the night came from the water heater kicking on.

Not only does it give the dwellers the creeps, the specter of a specter hanging over a house can have a very real-world impact.

A "psychologically impacted" house, such as one that is reportedly haunted, can sell for 3 percent less and take an average of 45 percent longer to sell than other properties, according to a 2001 study published in the peer-reviewed Journal of Real Estate Research.

In 2010, after its owner was shot and killed in his bedroom by an intruder, a Maryland home sold for $200,000 below asking price.

And in 2007, a woman moving from California with her two kids after her husband died bought a home in Thornton, Pa., for $650,000, only to learn from a neighbor that there had been a murder-suicide in the house. According to her lawsuit against the sellers, which asked to have the transaction rescinded, they had bought the house below market value at $450,000 and then flipped it for comps.

Though they knew of the house's bloody past, the suit alleged, they kept it hidden from the buyer, whose children learned about it while trick-or-treating on Halloween.

Standard contract law holds that sellers are responsible for any "material" defects to a good or service they're representing, but the laws of more than 20 states don't consider tragic events such as a murder-suicide to impact the building structure.

"Material is the key word," said Mary Pope-Handy, a real estate agent who sells houses in Silicon Valley and who publishes stories on her Haunted Real Estate Blog. "In Oregon they only consider material anything that impacts the physical structure. In California, it's anything that impacts the sense of a property's value and can include intangible things like school issues and pollution."

While acknowledging the site's novelty appeal, the Diedinhouse.com founder also sees it as a force for consumer protection.

"The disclosure laws say you have to tell someone about a water leak or aging roof," he said. "A water leak can be repaired; you can't reverse a violent death."

A text in the night put Roy Condrey on the trail of the dead.

"Did you know that your house is haunted?" read the letters glowing on his screen. It wasn't a message from beyond, but rather came from one of the tenants in the properties he rents out to supplement his income as a software project manager.

But the text got him pondering: Even if you suspected you had a paranormal force inhabiting your home, how could you tell if someone died in it?

Thus was Diedinhouse.com born. The site cross references between public records and other databases to find who used to live in a particular U.S. address, whether they're alive or not, and if they died while in the house. It can tell prospective homebuyers information the seller isn't obligated to disclose, which can sometimes lower a house's final price.

The night the idea was germinating, Condrey sat in front of the computer and began searching for answers. He discovered it's not that easy to electronically dig up a body under your roof.

From one source he could get a list of everyone who lived in the house. Then he had to check each name against another list to see if they were alive. Other databases and searches could turn up clues as to whether their death happened at the address itself. Few states require sellers to disclose if anyone died in the home, even if it was a murder-suicide that everyone else in the neighborhood knows about.

By and large, it's let the buyer beware ... of ghosts.

In that informational void Condrey saw opportunity. He grabbed a few programmer pals, and in June of this year his wesbite was spawned. In the first five months, it sold a few thousand reports for $11.99 per U.S. address searched. A few Halloween-minded media mentions later and it's now selling a thousand per day.

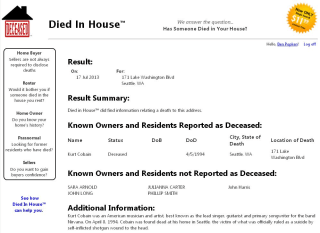

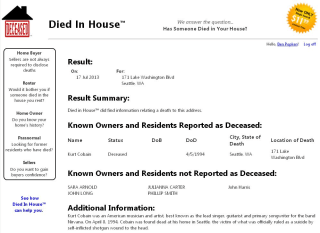

Diedinhouse.com

A sample Diedinhouse report showing the house where the late Nirvana frontman Kurt Cobain lived and took his life.

"I can't confirm or deny ghosts," said Condrey. "I want to know if I'm moving into Andrea Yates' house where she drowned five children in the bathtub."

It's like a Carfax for haunted houses.

Besides the curious and those in the spooky spirit, the site is also getting traction among ghost hunters.

Leslie Self, 36, a caregiver and pro bono paranormal investigator in Craig, Colo., has used a Diedinhouse report for six of his recent clients.

In one case, a couple was bedeviled by knocking sounds in the night in the home the woman inherited from her grandmother. Self ran a search on Diedinhouse and didn't find any evidence the grandmother had died in the house. After descending into the basement, he discovered the ghastly noises in the night came from the water heater kicking on.

Not only does it give the dwellers the creeps, the specter of a specter hanging over a house can have a very real-world impact.

A "psychologically impacted" house, such as one that is reportedly haunted, can sell for 3 percent less and take an average of 45 percent longer to sell than other properties, according to a 2001 study published in the peer-reviewed Journal of Real Estate Research.

In 2010, after its owner was shot and killed in his bedroom by an intruder, a Maryland home sold for $200,000 below asking price.

And in 2007, a woman moving from California with her two kids after her husband died bought a home in Thornton, Pa., for $650,000, only to learn from a neighbor that there had been a murder-suicide in the house. According to her lawsuit against the sellers, which asked to have the transaction rescinded, they had bought the house below market value at $450,000 and then flipped it for comps.

Though they knew of the house's bloody past, the suit alleged, they kept it hidden from the buyer, whose children learned about it while trick-or-treating on Halloween.

Standard contract law holds that sellers are responsible for any "material" defects to a good or service they're representing, but the laws of more than 20 states don't consider tragic events such as a murder-suicide to impact the building structure.

"Material is the key word," said Mary Pope-Handy, a real estate agent who sells houses in Silicon Valley and who publishes stories on her Haunted Real Estate Blog. "In Oregon they only consider material anything that impacts the physical structure. In California, it's anything that impacts the sense of a property's value and can include intangible things like school issues and pollution."

While acknowledging the site's novelty appeal, the Diedinhouse.com founder also sees it as a force for consumer protection.

"The disclosure laws say you have to tell someone about a water leak or aging roof," he said. "A water leak can be repaired; you can't reverse a violent death."

Subscribe to:

Posts (Atom)